The digital age has transformed the way people conduct financial transactions. With the convenience of online banking and e-commerce, billions of transactions occur daily across the globe. Yet, beneath this seamless vclubshop digital infrastructure lies a shadowy world where stolen financial information is bought and sold: the credit card (CC) marketplaces of the Dark Web. These platforms, operating in secrecy, fuel cybercrime and pose serious threats to individuals, businesses, and financial institutions alike. This blog explores fresh insights into CC marketplace activity, the trends shaping these hidden networks, and what you need to know to stay protected.

Understanding CC Marketplaces

Credit card marketplaces, or CC marketplaces, are online platforms where stolen financial information is exchanged. These marketplaces exist primarily on the Dark Web, accessible only through specialized browsers such as Tor. Their primary function is to facilitate anonymous transactions, making it extremely difficult for law enforcement to track buyers and sellers.

Although the focus is often on stolen credit card data, modern CC marketplaces also offer:

- Bank account credentials

- Digital wallets and payment service accounts, including PayPal and cryptocurrency wallets

- Personal identification data for identity theft

- Fraud tools, malware, and instructional guides for exploiting stolen data

Unlike early forums or chat-based trading platforms, contemporary CC marketplaces often resemble legitimate e-commerce websites, complete with product listings, categories, seller ratings, and reviews. This professionalized approach increases trust among buyers and enhances the efficiency of criminal operations.

Growth and Evolution of CC Marketplaces

CC marketplaces have evolved significantly over the past decade. Initially, stolen credit card information was traded on simple forums or through informal networks. Today, marketplaces are highly structured and sophisticated, providing a wide range of stolen data and even integrated fraud tools.

Key factors driving this growth include:

- Increase in Digital Transactions – As more financial activities move online, the volume of valuable data for cybercriminals grows.

- Anonymity and Security Tools – Tor, VPNs, and cryptocurrencies make it safer for cybercriminals to buy and sell stolen data anonymously.

- Organized Crime Networks – Many CC marketplaces are supported by coordinated international cybercrime syndicates, providing stolen data and infrastructure support.

This evolution demonstrates the adaptability and resilience of CC marketplaces in response to technological advancements and law enforcement efforts.

Fresh Insights into CC Marketplace Activity

Recent research and monitoring have revealed several emerging trends in CC marketplace activity, offering insight into the current state of the cybercrime ecosystem:

- Diversification of Stolen Assets – While credit cards remain central, marketplaces now frequently offer bank account access, digital wallets, cryptocurrency wallets, and even credentials for online services. This diversification enables criminals to exploit multiple financial channels simultaneously.

- Tiered Pricing Models – Stolen data is priced based on factors such as account balance, credit limit, card type, and geographic location. High-value information from reputable financial institutions commands premium prices, while lower-tier data is sold in bulk at discounted rates.

- Subscription and Bulk Offers – Some marketplaces offer subscription services or bulk data packages, providing buyers with ongoing access to fresh stolen information. This recurring model mimics legitimate subscription-based services, creating a continuous revenue stream for sellers.

- Professionalized Seller Ecosystem – Many marketplaces feature seller ratings, feedback, and dispute resolution, ensuring quality and building trust. These features encourage repeat business and expand criminal networks.

- Integration with Fraud Tools – Advanced marketplaces offer malware, phishing kits, and instructional guides, helping buyers exploit stolen data efficiently and effectively.

These trends suggest that CC marketplaces are becoming more sophisticated, professionalized, and difficult to disrupt.

The Role of Cryptocurrency in CC Marketplaces

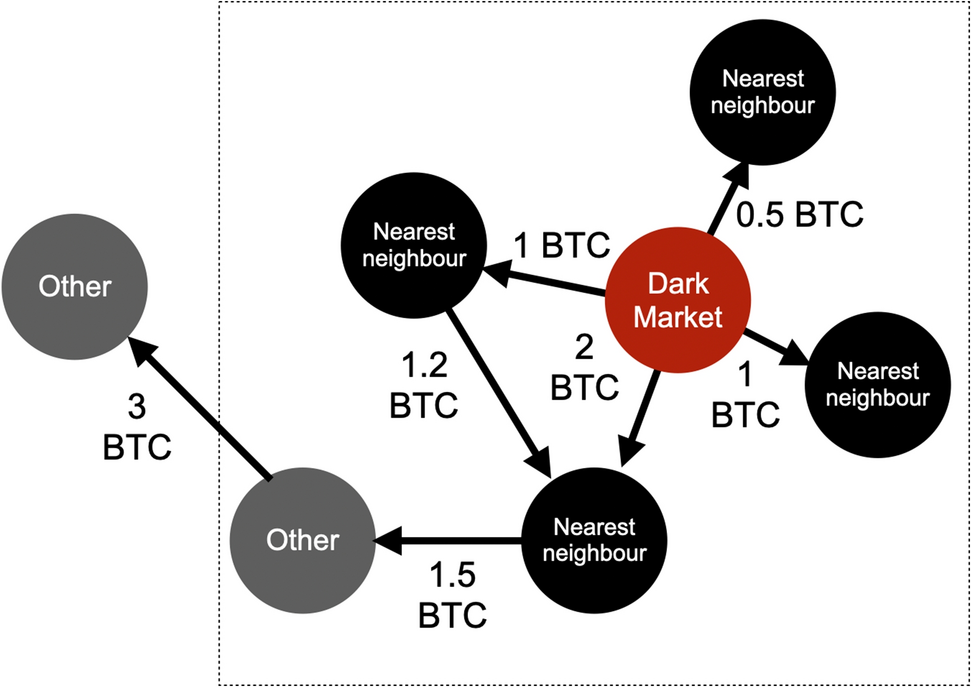

Cryptocurrency plays a crucial role in enabling CC marketplace transactions. Digital currencies like Bitcoin and vclubshop login Monero provide anonymity and security, allowing buyers and sellers to complete transactions without exposing personal identities.

Cryptocurrencies also enable international trade, allowing transactions to occur seamlessly across borders. Escrow services and automated payment systems further enhance trust, ensuring buyers receive the data they purchase while sellers receive secure payment. This use of cryptocurrency mirrors legitimate e-commerce platforms but in a highly illicit context.

Impacts on Individuals and Businesses

The activity within CC marketplaces has real-world consequences that extend far beyond the Dark Web:

- Financial Loss – Unauthorized transactions using stolen credit card data can result in significant financial loss for victims. While banks may reimburse fraudulent charges, the process is often lengthy and stressful.

- Identity Theft – Stolen personal information can lead to identity theft, with criminals opening new accounts, obtaining loans, or committing other fraud in someone else’s name.

- Corporate Exposure – Businesses face chargebacks, reputational damage, and increased costs for fraud detection and mitigation. They may also experience operational disruptions when large-scale attacks occur.

- Global Cybercrime Growth – CC marketplaces reinforce organized cybercrime networks, facilitating large-scale, coordinated attacks and further complicating law enforcement efforts.

The widespread impact of these activities highlights the need for vigilance, monitoring, and proactive cybersecurity measures.

Law Enforcement Challenges

Combating CC marketplaces presents significant obstacles for law enforcement:

- Anonymity Networks – Tor and other privacy tools make it difficult to trace users.

- International Jurisdictions – Criminal networks often span multiple countries, requiring cross-border cooperation for enforcement.

- Rapid Adaptation – When one marketplace is shut down, others quickly emerge, often with improved security and infrastructure.

Authorities continue to leverage digital forensics, blockchain analysis, and undercover operations to infiltrate these networks. However, the decentralized and adaptive nature of CC marketplaces ensures that the threat persists.

Protecting Yourself Against CC Marketplace Risks

Although most individuals will never directly interact with CC marketplaces, the effects of their activities can impact anyone. Key strategies to reduce risk include:

- Regular Account Monitoring – Frequently check credit card and bank statements for unusual or unauthorized activity.

- Strong, Unique Passwords – Avoid reusing passwords and enable two-factor authentication for online accounts.

- Data Breach Awareness – Sign up for alerts from services that notify you if your personal information has been exposed.

- Device Security – Install antivirus software, firewalls, and avoid suspicious downloads or links.

- Credit Alerts and Freezes – These measures prevent unauthorized account creation and reduce the risk of identity theft.

Proactive security practices are essential for mitigating the risks posed by CC marketplace activity.

The Future of CC Marketplaces

The landscape of CC marketplaces is likely to continue evolving. Cybercriminals are expected to leverage artificial intelligence, automated attacks, and sophisticated malware to enhance their operations. As these marketplaces grow more professionalized, they may become increasingly difficult to disrupt.

At the same time, cybersecurity defenses are advancing. Financial institutions and businesses are investing in AI-based fraud detection, biometric authentication, and real-time monitoring to identify and prevent unauthorized transactions. Despite these advances, the dynamic and adaptive nature of CC marketplaces means vigilance remains essential.

Conclusion

CC marketplaces on the Dark Web represent a shadowy yet highly organized component of the cybercrime ecosystem. The latest insights into their activity reveal increasing sophistication, professionalization, and diversification of stolen financial data. While these marketplaces operate in hidden streams of the digital world, their effects—financial loss, identity theft, and corporate exposure—are tangible and far-reaching.

Understanding these trends and adopting proactive security measures is critical for protecting personal and financial information. Monitoring accounts, using strong passwords, staying alert to breaches, and securing devices are key strategies in defending against the threats emerging from CC marketplaces. Awar